Calculate depreciation of house

Unrecaptured Section 1250. It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years.

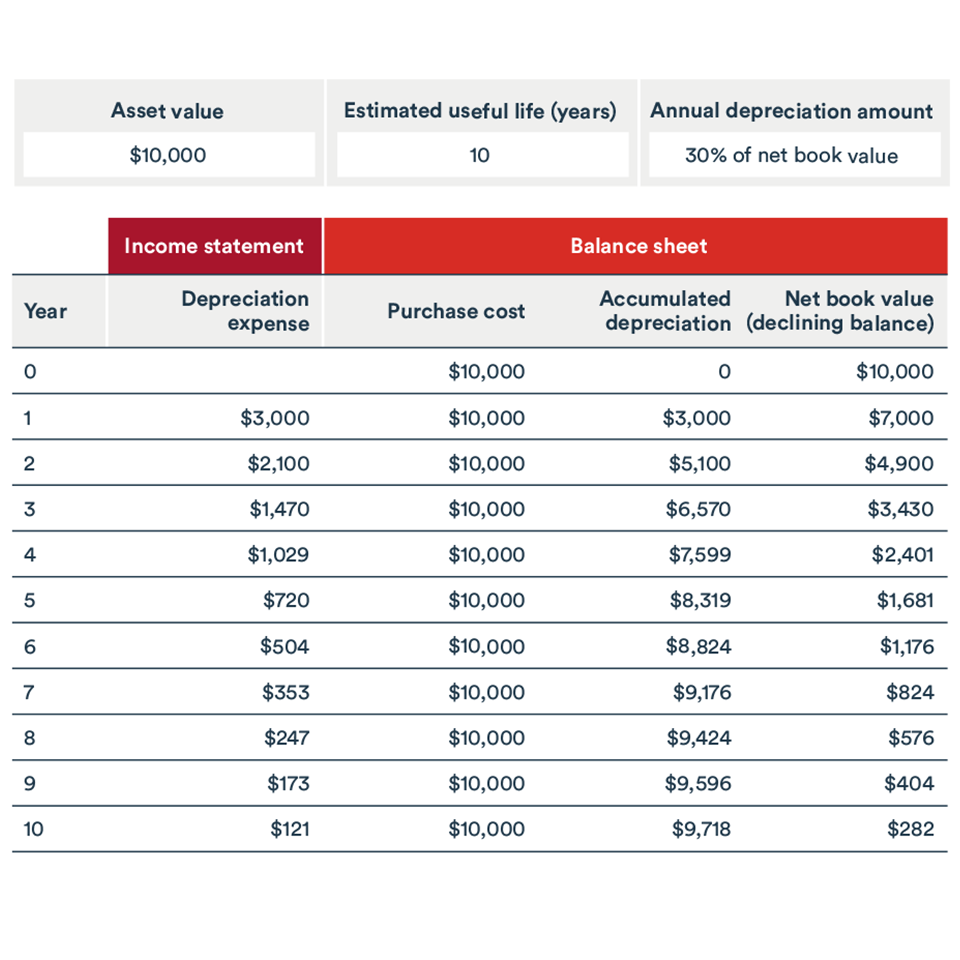

Depreciation Schedule Template For Straight Line And Declining Balance

For instance if a buyer is selling a property after 10 years of construction the selling price of the structure can be calculated.

. Basically it recognises that the building itself plus its internal furnishings and fittings will become worn over time and eventually need to be replaced. To use this method the following calculation is used. S ay Tim purchased a home for 300000 and sold it 20 years later for 500000.

The unrecaptured section 1250 gain is a type of depreciation-recapture income that is realized on the sale of depreciable real estate. The sum-of-the-years digits depreciation calculation is sort of in-between the straight line method and the declining balance method. Web Amortization and depreciation are two methods of calculating the value for business assets over time.

This period is called its life expectancy lifespan or useful life. Web Unrecaptured Section 1250 Gain. Web To calculate the replacement cost first determine the building cost per square foot in your area and then multiply that by your homes square footage.

SYD as its also called takes the number of years of the items expected useful life and then. Web As for the residence itself the IRS requires you to calculate depreciation over its 275 useful years using a different method called the modified accelerated cost recovery system. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate.

Web This type of depreciation calculation is useful for items that quickly become obsolete like tech hardware. To calculate the depreciation of building component take out the ratio of years of construction and total age of the building. Section 1250 helps protect against this kind of tax avoidance.

When it has crossed it lifespan it begins to deteriorate. Web The most accurate way to calculate the cost of depreciation for a fleet is by using the accelerated method. Web A new house purchased for 730000.

As per formula iv. I Calculate the depreciation percentage based on sinking fund method for a building at the. See the cash flow generated.

Property owners have two ways of calculating depreciation on their assets. The National Association of Home Builders estimated the average build price as between 100 and 155 per square foot. After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year.

The depreciation value of a pump is 20. As a homeowner your appliance will work for you efficiently and effectively over a period of time before it starts to decline. There are however a few things to keep in mind.

Web If the investor uses a depreciation schedule for the property they can partly deduct most future replacements and repairs yearly. Web How to calculate property depreciation. Web Lets take a look at an example when it comes to calculating the cost basis in real estate.

Web Depreciation percentage S x A 100. Web Annual Depreciation Value. Amortization is the practice of spreading an intangible assets cost over that assets useful.

To calculate the impact of depreciation compare an example for a commercial truck worth 100000. Web Depreciation is a tax deduction available to property investors. Web BMT Tax Depreciation works with your accountant to ensure that your depreciation claim for your investment property is maximised each financial year.

This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life. Commercial Business. During the time that he was the homeowner Tim put 30000 worth of improvements into the property including a new backyard fence and numerous kitchen and bathroom.

Sinking fund at given rate of interest for the total life of a building Example 9. Web Without Section 1250 strategic house-flippers could buy property quickly write off a portion of it and then sell it for a profit without giving the IRS their fair share. It allows you to claim a tax deduction for the wear and tear over time on most old or new investment properties.

The ATO has decided that after May 2017 depreciation on an investment residential property cant the deducted from income tax. Calculate depreciation deductions for your investment property. So if you use an accelerated depreciation method then sell the property at a profit the IRS makes an.

Web For an independent house the average lifespan of any building is 60 years.

The Hidden Costs Of Selling Your Home Selling House Home Warranty Companies Real Estate Tips

13 Depreciation Schedule Templates Free Word Excel Templates Schedule Templates Excel Templates Schedule Template

This Balance Sheet Template Allows Year Over Year Comparison Including Accumulated Depreciation Balance Sheet Template Balance Sheet Cash Flow Statement

Pin On Front Door

Depreciation What Is The Depreciation Expense

Download The Depreciation Calculator For Excel From Vertex42 Com Calculator Excel Calculators

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Small Business Plan Template Financial Statement

13 Depreciation Schedule Templates Free Word Excel Templates Schedule Templates Excel Templates Templates

What Is Depreciation Bdc Ca

Depreciation Schedule Is A Systematic And An Accounting Operation For Calculating The Amount Of Book Value Of A F Schedule Templates Excel Templates Templates

Appreciation And Depreciation Calculator Https Salecalc Com Appdep Appreciation Calculator Calculators

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Investing Rental Property Calculator Roi Mls Mortgage Cash Flow Statement Investing Mortgage Refinance Calculator

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

13 Depreciation Schedule Templates Free Word Excel Templates Schedule Templates Excel Templates Templates

How Much Home Can I Afford Mortgage Affordability Calculator